PRELIMINARY COPY - SUBJECT TO COMPLETION Marathon Petroleum Corporation intends to release definitive copies of the Proxy Statement to shareholders on or about March | |||||||||||||||||||||||||||||||||||

| NOTICE OF | ||||||||||||||||||||||||||||||||||

| You are invited to attend Marathon Petroleum Corporation’s | ||

DATE AND TIME | AGENDA | ||||||||||||||||||||||

| Wednesday, April | |||||||||||||||||||||||

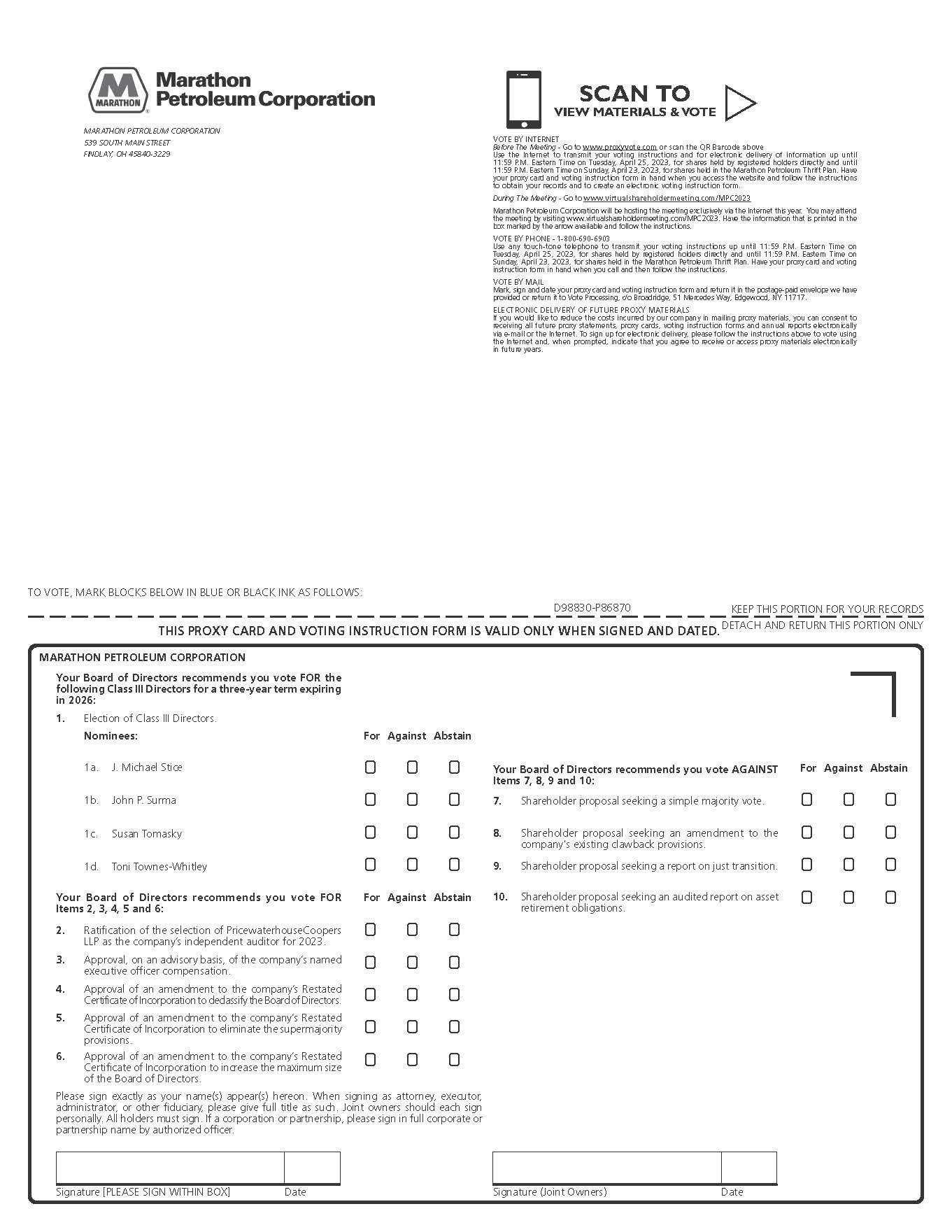

| 1. Elect the four director nominees for Class | |||||||||||||||||||||||

| 10 a.m. Eastern Daylight Time | 2. Ratify the appointment of our independent auditor for | ||||||||||||||||||||||

| 3. Approve, on an advisory basis, our named executive officer compensation | |||||||||||||||||||||||

| LOCATION | 4. | ||||||||||||||||||||||

The meeting will be held virtually at: www.virtualshareholder meeting.com/MPC2024 | |||||||||||||||||||||||

| 5. Approve an amendment to the Certificate of Incorporation to provide for officer exculpation | |||||||||||||||||||||||

| 6. Approve an amendment to the Certificate of Incorporation to declassify the Board of Directors | |||||||||||||||||||||||

| þ | Your vote is important. Even if you plan to attend the virtual Annual Meeting, please vote as soon as possible using one of the following options: | ||||||||||||||||||||||

|  |  | |||||||||||||||||||||

| Via the Internet: | Call Toll-Free: | Mail Signed Proxy Card: | |||||||||||||||||||||

| Follow the instructions in the Notice, proxy card or voting instruction form. | Call the toll-free number on your proxy card or voting instruction form. | Follow the instructions on your proxy card or voting instruction form. | |||||||||||||||||||||

Shareholders of record at the close of business on | ||

We provide our proxy materials, including our Proxy Statement and Annual Report, over the internet. This expedites your receipt of proxy materials, conserves natural resources and lowers the cost of the meeting. On or about March | ||

| We thank you for your continued support and look forward to your attendance at our virtual Annual Meeting. | ||

| By order of the Board of Directors, | |||||||||||||||||||||||

| |||||||||||||||||||||||

Molly R. Benson | |||||||||||||||||||||||

| IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS: | |||||||||||||||||||||||

The Proxy Statement and Marathon Petroleum Corporation’s | |||||||||||||||||||||||

| TABLE OF CONTENTS | ||

| INDEX OF FREQUENTLY REQUESTED INFORMATION | GLOSSARY OF TERMS AND ACRONYMS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Auditor fees | ACB | Annual Cash Bonus program | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Board diversity | Annual Meeting | Marathon Petroleum Corporation’s 2024 annual meeting of shareholders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Board, committee and individual director evaluations | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Board | Board of Directors, Marathon Petroleum Corporation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Board leadership structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Board meeting director attendance | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bylaws | Amended and Restated Bylaws of Marathon Petroleum Corporation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CEO pay ratio | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Clawback policy | CD&A | Compensation discussion and analysis | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Codes of conduct and ethics | CEO | Chief Executive Officer | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Committees of the Board | CFO | Chief Financial Officer | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Communicating with the Board | Company | Marathon Petroleum Corporation | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Compensation reference group | DCF | Distributable cash flow at MPLX LP | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Director biographies | DGCL | Delaware General Corporation Law | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Director board commitments | ERM | Enterprise risk management | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Director compensation table | ESG | Environmental, social and governance | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Director independence | Exchange Act | Securities Exchange Act of 1934, as amended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Director skills, expertise and composition matrix | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GAAP | Generally Accepted Accounting Principles in the United States | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Executive compensation mix | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Human capital management | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GHG | Greenhouse gas | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Independent Chairman of the Board | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LTI | Long-term incentive | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Just transition report | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Marathon | Marathon Petroleum Corporation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oversight of climate risk | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MPC | Marathon Petroleum Corporation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oversight of cybersecurity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MPLX | MPLX LP | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oversight of human capital management and succession planning | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NEO | Named executive officer | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NYSE | New York Stock Exchange | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oversight of political engagement and public policy | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PSUs | Performance share units | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oversight of risk management | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PwC | PricewaterhouseCoopers LLP | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prohibition on hedging and pledging | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RSUs | Restricted stock units | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Proxy access | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SEC | U.S. Securities and Exchange Commission | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Related party transactions | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TSR | Total shareholder return | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Say-on-pay | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder engagement program | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder proposals and nominees for the 2025 annual meeting | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PROXY STATEMENT SUMMARY | ||||||||||||||||||||||||||||||||||||||

| This summary highlights information contained in this Proxy Statement, which is first being sent or made available to shareholders on or about March | ||||||||||||||||||||||||||||||||||||||

| Annual Meeting and Voting Information | ||||||||||||||||||||||||||||||||||||||

|  |  |  | |||||||||||||||||||||||||||||||||||

| DATE AND TIME | LOCATION | RECORD DATE | VOTING | |||||||||||||||||||||||||||||||||||

| Wednesday, April | The Annual Meeting will be held virtually at: www.virtualshareholder meeting.com/ | Only holders of record of MPC’s common stock as of the record date will be entitled to notice and to vote | ||||||||||||||||||||||||||||||||||||

| 10 a.m. EDT | Shares outstanding: | |||||||||||||||||||||||||||||||||||||

MPC’s See “FAQs About Voting and the Annual Meeting” beginning on page | ||||||||||||||||||||||||||||||||||||||

| Voting Items | ||||||||||||||||||||||||||||||||||||||

Your vote is important. Please vote your proxy promptly so that your shares can be represented, even if you plan to attend the virtual Annual Meeting. You can vote via the internet or telephone by following the voting procedures described in the Notice, proxy card or voting instruction form, or by returning your completed and signed proxy card or voting instruction form in the provided envelope. | ||||||||||||||||||||||||||||||||||||||

| Proposal | Page Reference | Board Recommendation | ||||||||||||||||||||||||||||||||||||

Proposal 1. Elect four director nominees to Class | FOR each nominee | |||||||||||||||||||||||||||||||||||||

Proposal 2. Ratify the appointment of our independent auditor for | FOR | |||||||||||||||||||||||||||||||||||||

Proposal 3. Approve, on an advisory basis, our named executive officer compensation | FOR | |||||||||||||||||||||||||||||||||||||

Proposal 4. | 1 YEAR | |||||||||||||||||||||||||||||||||||||

Proposal 5. Approve an amendment to the Certificate of Incorporation to provide for officer exculpation | FOR | |||||||||||||||||||||||||||||||||||||

Proposal 6. Approve an amendment to the Certificate of Incorporation to declassify the Board of Directors | FOR | |||||||||||||||||||||||||||||||||||||

Proposal | ||||||||||||||||||||||||||||||||||||||

| FOR | ||||||||||||||||||||||||||||||||||||||

| AGAINST | ||||||||||||||||||||||||||||||||||||||

| Additional Information | ||||||||||||||||||||||||||||||||||||||

Our principal executive offices are located at 539 South Main Street, Findlay, OH 45840, and our telephone number is (419) 422-2121. Our website address is | ||||||||||||||||||||||||||||||||||||||

| References throughout this Proxy Statement to | ||||||||||||||||||||||||||||||||||||||

| 1 | ||||||||

| PROXY STATEMENT SUMMARY | ||

| About Marathon Petroleum Corporation | ||||||||||||||||||||||||||||||||||||||||||||||||||

| With more than 135 years in the energy industry, Marathon Petroleum Corporation (NYSE: MPC) is a leading, integrated, downstream energy company headquartered in Findlay, Ohio. | ||||||||||||||||||||||||||||||||||||||||||||||||||

We and our employees are focused on doing our part to meet the | ||||||||||||||||||||||||||||||||||||||||||||||||||

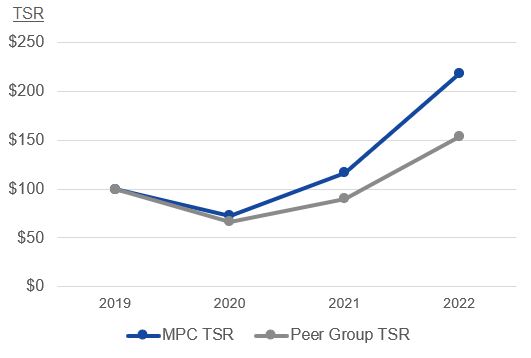

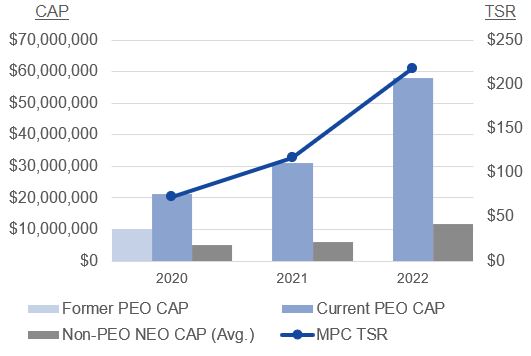

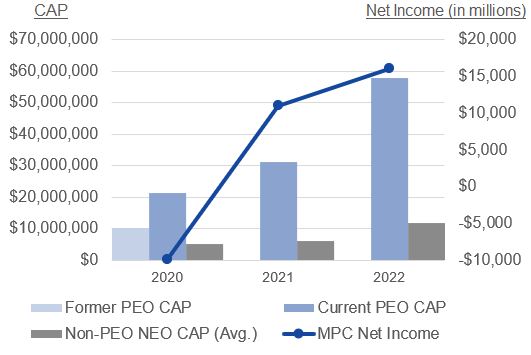

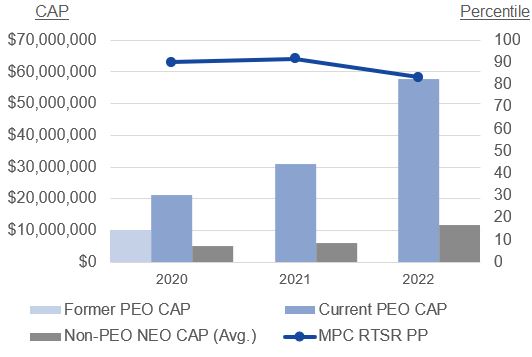

| TOTAL SHAREHOLDER RETURN | EARNINGS | |||||||||||||||||||||||||||||||||||||||||||||||||

| $ | net income attributable to MPC | ||||||||||||||||||||||||||||||||||||||||||||||||

| ADJUSTED EBITDA* | ||||||||||||||||||||||||||||||||||||||||||||||||||

$ | adjusted earnings before interest, taxes, depreciation and amortization | |||||||||||||||||||||||||||||||||||||||||||||||||

| CASH FROM OPERATIONS | ||||||||||||||||||||||||||||||||||||||||||||||||||

$ | net cash from operations | |||||||||||||||||||||||||||||||||||||||||||||||||

| SHAREHOLDER VALUE | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ~ | $ | $ | $5.0 billion | |||||||||||||||||||||||||||||||||||||||||||||||

| increase in our quarterly dividend (from | in dividends paid to shareholders in 2023 | of capital returned to shareholders through share repurchases | additional repurchase authorization (announced in | |||||||||||||||||||||||||||||||||||||||||||||||

| PROGRESS ON RENEWABLES | RECOGNITION | |||||||||||||||||||||||||||||||||||||||||||||||||

Produced nearly 149 million gallons of renewable diesel at our Dickinson, ND, renewable diesel facility 2024 capital plan allocates ~40% of MPC’s growth capital to renewables and carbon-reduction projects | Member of Dow Jones Sustainability North America Index for | |||||||||||||||||||||||||||||||||||||||||||||||||

Energy Star® Partner of the Five MPC refineries earned EPA Energy Star certifications in 2023. Since refineries first became eligible for Energy Star certification in 2006, MPC has earned more certifications than all other refining companies combined. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| *NON-GAAP FINANCIAL MEASURE | ||||||||||||||||||||||||||||||||||||||||||||||||||

| “Adjusted EBITDA” is not a measure of financial performance under | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | Marathon Petroleum Corporation | |||||||

| PROXY STATEMENT SUMMARY | ||

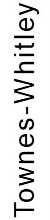

| Overview of Our Board of Directors | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|  |  |  |  |  | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Abdulaziz F. Alkhayyal | Evan Bayh | Charles E. Bunch | Jonathan Z. Cohen | Edward G. Galante | Michael J. Hennigan | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|  |  |  |  |  | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Kim K.W. Rucker | Frank M. Semple | J. Michael Stice | John P. Surma | Susan Tomasky | Toni Townes-Whitley | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Director Since | Committee Memberships | Other Current Public Company Boards | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Name | Age* | Independent | Occupation | A | C | G | S | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alkhayyal | 69 | 2016 | ü | Retired Senior Vice President, Industrial Relations, Saudi Aramco | ¡ | ¡ | ¤ | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bayh | 67 | 2011 | ü | Senior Advisor, Apollo Global Management | ¡ | µ | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bunch | 73 | 2015 | ü | Retired Chairman and CEO, PPG Industries | ¡ | µ | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cohen | 52 | 2019 | ü | Founder, CEO and President, Hepco Capital Management, LLC | ¤ | ¡ | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Galante | 72 | 2018 | ü | Retired Senior Vice President and Management Committee Member, ExxonMobil Corporation | µ | ¡ | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hennigan | 63 | 2020 | CEO | President and CEO, Marathon Petroleum Corporation | ¡ | 2** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rucker | 56 | 2018 | ü | Former Executive Vice President, General Counsel and Secretary, Andeavor | ¡ | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Semple | 71 | 2021 | ü | Retired Chairman, President and CEO, MarkWest Energy Partners, L.P. | ¡ | ¡ | 1** | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stice | 64 | 2017 | ü | Professor, The University of Oklahoma | ¡ | ¤ | ¡ | 1** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Surma | 68 | 2011 | ü | Chairman of the Board, Marathon Petroleum Corporation | INDEPENDENT CHAIRMAN | 3** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tomasky | 70 | 2018 | ü | Retired President, AEP Transmission | µ | ¡ | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Townes-Whitley | 59 | 2023 | ü | Former President, U.S. Regulated Industries, Microsoft Corporation | ¡ | ¡ | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A | Audit Committee | C | Compensation and Organization Development Committee | G | Corporate Governance and Nominating Committee | S | Sustainability and Public Policy Committee | µ | Chair | ¤ | Vice Chair | ¡ | Member | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| * As of April 26, 2023. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ** Includes service on the board of directors of MPLX GP LLC, a wholly owned subsidiary of MPC. Under our Corporate Governance Principles, concurrent service on the boards of MPC and MPLX GP LLC is counted as one public company board for purposes of assessing the level of public company board commitments. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| IN MEMORIAM – STEVEN A. DAVIS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

We were deeply saddened by the death of our friend and colleague, Steven A. Davis, in July 2022. Mr. Davis served on the Board for nine years, and we remain grateful for his thoughtful leadership in many areas, including corporate governance and corporate responsibility. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Overview of Our Board of Directors | |||||||||||||||||||||||||||||||||||||||||||||||

Age (as of April 24, 2024) | Director Since | Committee Memberships | Other Current Public Company Boards | ||||||||||||||||||||||||||||||||||||||||||||

| Name and Principal Occupation | Independent | A | C | G | S | ||||||||||||||||||||||||||||||||||||||||||

| Abdulaziz F. Alkhayyal Retired Senior Vice President, Industrial Relations, Saudi Aramco | 70 | 2016 | ü | ¡ | ¡ | ¤ | 2 | |||||||||||||||||||||||||||||||||||||||

| Evan Bayh Senior Advisor, Apollo Global Management | 68 | 2011 | ü | ¡ | µ | 3 | ||||||||||||||||||||||||||||||||||||||||

| Charles E. Bunch Retired Chairman and CEO, PPG Industries, Inc. | 74 | 2015 | ü | ¡ | µ | 1 | ||||||||||||||||||||||||||||||||||||||||

| Jonathan Z. Cohen Founder, CEO and President, Hepco Capital Management, LLC | 53 | 2019 | ü | ¤ | ¡ | — | ||||||||||||||||||||||||||||||||||||||||

| Eileen P. Drake Former CEO and President, Aerojet Rocketdyne Holdings, Inc. | 58 | 2024 | ü | ¡ | ¡ | 1 | ||||||||||||||||||||||||||||||||||||||||

| Kimberly Ellison-Taylor Former Executive Director, Finance Thought Leadership, Oracle Corporation | 54 | 2024 | ü | ¡ | ¡ | 2 | ||||||||||||||||||||||||||||||||||||||||

| Edward G. Galante Retired Senior Vice President and Management Committee Member, ExxonMobil Corporation | 73 | 2018 | ü | µ | ¡ | 2 | ||||||||||||||||||||||||||||||||||||||||

| Michael J. Hennigan CEO, Marathon Petroleum Corporation | 64 | 2020 | CEO | ¡ | 2 | * | ||||||||||||||||||||||||||||||||||||||||

| Kim K.W. Rucker Former Executive Vice President, General Counsel and Secretary, Andeavor | 57 | 2018 | ü | ¡ | ¤ | ¡ | 3 | |||||||||||||||||||||||||||||||||||||||

| Frank M. Semple Retired Chairman, President and CEO, MarkWest Energy Partners, L.P. | 72 | 2021 | ü | ¡ | ¡ | 1 | * | |||||||||||||||||||||||||||||||||||||||

| J. Michael Stice Professor, The University of Oklahoma | 65 | 2017 | ü | ¡ | ¤ | ¡ | 2 | * | ||||||||||||||||||||||||||||||||||||||

| John P. Surma Chairman of the Board, Marathon Petroleum Corporation | 69 | 2011 | ü | INDEPENDENT CHAIRMAN OF THE BOARD | 3 | * | ||||||||||||||||||||||||||||||||||||||||

| Susan Tomasky Retired President, AEP Transmission | 71 | 2018 | ü | µ | ¡ | 2 | ||||||||||||||||||||||||||||||||||||||||

| * Includes service on the board of directors of MPLX GP LLC, a wholly owned subsidiary of MPC. Our Corporate Governance Principles count concurrent service on the boards of MPC and MPLX GP LLC as one public company board for purposes of assessing the level of public company board commitments. | A | Audit Committee | µ | Chair | |||||||||||||||||||||||||||||||||||||||||||

| C | Compensation and Organization Development Committee | ¤ | Vice Chair | ||||||||||||||||||||||||||||||||||||||||||||

| G | Corporate Governance and Nominating Committee | ¡ | Member | ||||||||||||||||||||||||||||||||||||||||||||

| S | Sustainability and Public Policy Committee | ||||||||||||||||||||||||||||||||||||||||||||||

| 3 | ||||||||

| PROXY STATEMENT SUMMARY | ||

| Composition of Our Board | |||||||||||||||||||||||

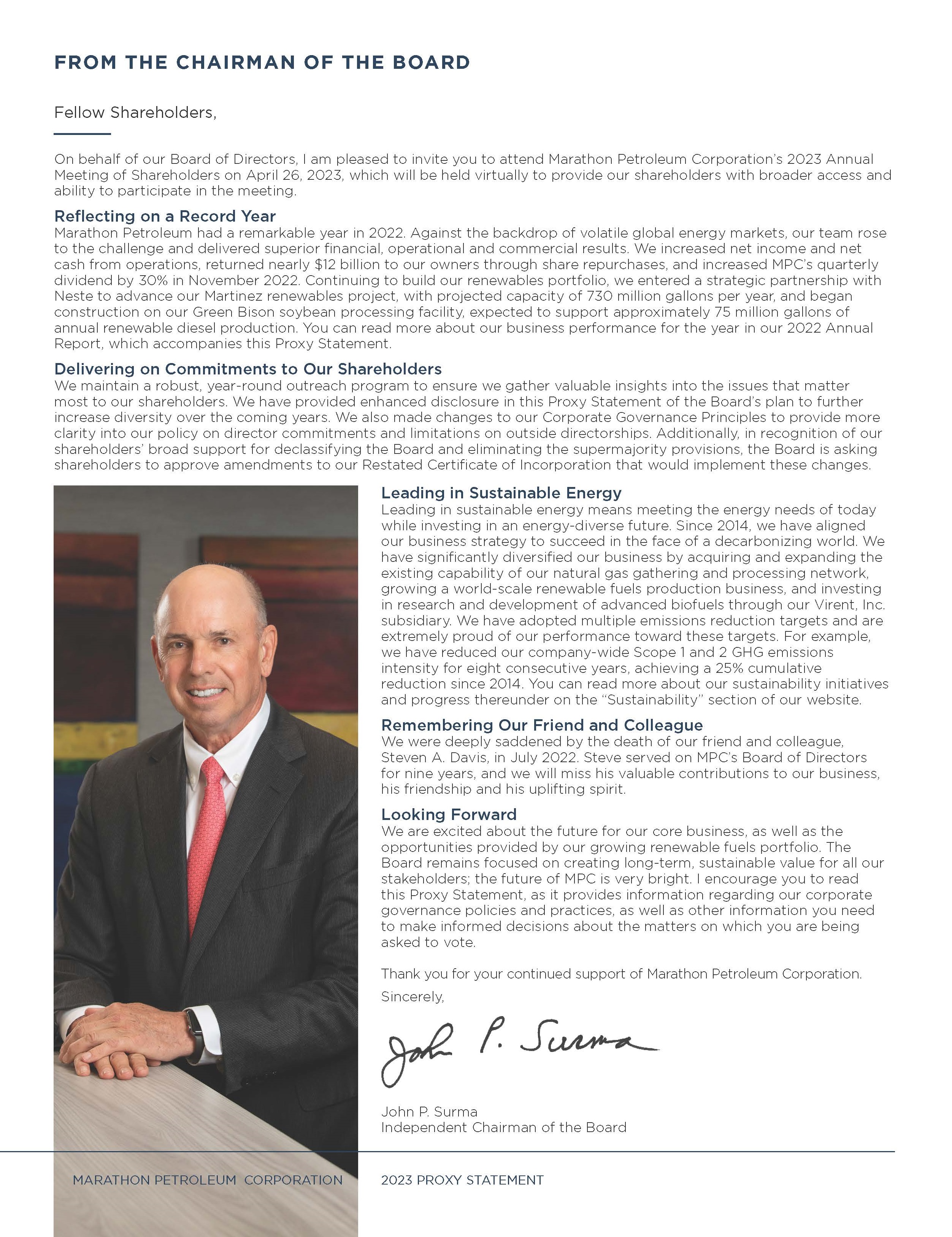

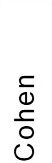

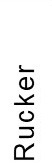

| INDEPENDENT BOARD | BOARD DIVERSITY | ||||||||||||||||||||||

|  | ||||||||||||||||||||||

| Women | |||||||||||||||||||||||

| |||||||||||||||||||||||

| Racial/Ethnic Diversity and Native American Tribal Membership | |||||||||||||||||||||||

11 of 12 Directors are Independent | 42% Diverse | ||||||||||||||||||||||

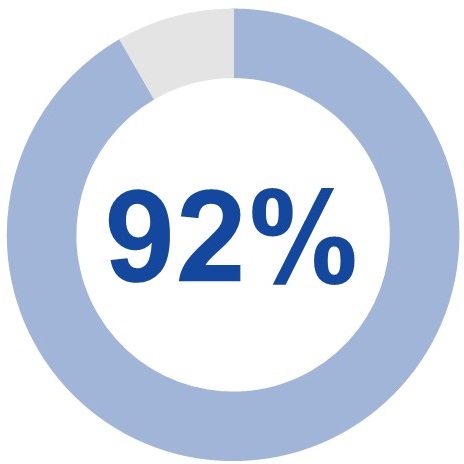

| DIRECTOR TENURE | DIRECTOR AGE | ||||||||||||||||||||||

|  | ||||||||||||||||||||||

| Year-Round Shareholder Engagement | |||||||||||||||||||||||

| We believe that regular dialogue with, and accountability to, our shareholders is critical to our success. Our management team participates in numerous investor meetings throughout the year to discuss our business and strategic priorities. Our core shareholder engagement team includes senior members of our investor relations, corporate governance, human resources and sustainability teams, supplemented by our Chief Executive Officer, Chief Financial Officer and Board Chair or other directors, as appropriate. These meetings include in-person, telephone and webcast engagements, as well as investor conferences and our annual meeting of shareholders. Shareholder feedback provides our Board and management with valuable insights on our business strategy and performance, corporate responsibility, executive compensation, sustainability initiatives and many other topics. | |||||||||||||||||||||||

| FALL ENGAGEMENT | PROXY STATEMENT | ||||||||||||||||||||||

| Our shareholder engagement team solicits and receives feedback from shareholders on governance practices and trends, Board composition, executive compensation, sustainability, human capital management and other shareholder priorities | ð | The Board uses shareholder feedback gathered from fall engagement to enhance disclosures and revise governance practices, the executive compensation program, sustainability practices or other programs and policies, as appropriate | |||||||||||||||||||||

| ñ | ò | ||||||||||||||||||||||

| ANNUAL MEETING | SPRING ENGAGEMENT | ||||||||||||||||||||||

| We receive and publish voting results from our annual meeting, which help shape our ongoing improvements and developments in governance practices, executive compensation, sustainability and other shareholder interest areas | ï | Our shareholder engagement team conducts additional outreach with shareholders to provide updates on changes made in response to shareholder feedback and to address management and shareholder proposals, as well as other topics of interest | |||||||||||||||||||||

During 2022, our shareholder engagement team: | |||||||||||||||||||||||

| Proactively reached out to shareholders representing | Met with shareholders representing | Conducted additional email outreach with major updates such as topical news releases and reports | |||||||||||||||||||||

| 71% | 41% | ||||||||||||||||||||||

| of our outstanding shares | of our outstanding shares | ||||||||||||||||||||||

| Composition of Our Board | |||||||||||||||||||||||||||||||||||

| INDEPENDENT BOARD | BOARD DIVERSITY | ||||||||||||||||||||||||||||||||||

|  | ||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||

| Women | |||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||

Racial/Ethnic Diversity and Native American Tribal Membership | |||||||||||||||||||||||||||||||||||

12of 13Directors are Independent | 46%Diverse | ||||||||||||||||||||||||||||||||||

| DIRECTOR TENURE | DIRECTOR AGE | ||||||||||||||||||||||||||||||||||

|  | ||||||||||||||||||||||||||||||||||

| Year-Round Shareholder Engagement | |||||||||||||||||||||||||||||||||||

| We believe that regular dialogue with, and accountability to, our shareholders is critical to our success. Our management team participates in numerous investor meetings throughout the year to discuss our business and strategic priorities. Our core shareholder engagement team includes senior members of our investor relations, corporate governance, human resources and sustainability teams, supplemented by our CEO, CFO and Board Chair or other directors, as appropriate. These meetings include in-person, telephone and webcast engagements, as well as investor conferences and our annual meeting of shareholders. Shareholder feedback provides our Board and management with valuable insights on our business strategy and performance, corporate responsibility, executive compensation, sustainability initiatives and many other topics. | |||||||||||||||||||||||||||||||||||

| FALL ENGAGEMENT | PROGRAM ENHANCEMENT | ||||||||||||||||||||||||||||||||||

| Our shareholder engagement team solicits and receives feedback from shareholders on governance practices and trends, Board composition, executive compensation, sustainability, human capital management and other shareholder priorities. | ð | The Board uses shareholder feedback to enhance disclosures, including in our proxy statement and sustainability reporting, and revise governance practices, the executive compensation program, sustainability practices or other programs and policies, as appropriate. | |||||||||||||||||||||||||||||||||

| ñ | ò | ||||||||||||||||||||||||||||||||||

| ANNUAL MEETING | SPRING ENGAGEMENT | ||||||||||||||||||||||||||||||||||

| We receive and publish voting results from our annual meeting, which help shape our ongoing improvements and developments in governance practices, executive compensation, sustainability and other shareholder interest areas. | ï | Our shareholder engagement team conducts additional outreach with shareholders to provide updates on changes made in response to shareholder feedback and to address management and shareholder proposals, as well as other topics of interest. | |||||||||||||||||||||||||||||||||

| 2023 Shareholder Engagement Program | |||||||||||||||||||||||||||||||||||

| Outreach to: | One-on-One Meetings with: | Additional Ways We Engaged: | |||||||||||||||||||||||||||||||||

Shareholders representing 70% of our outstanding shares | Shareholders representing 43% of our outstanding shares | •Quarterly earnings calls •Industry presentations and conferences •Email updates such as topical news releases and reports •Thematic engagements | |||||||||||||||||||||||||||||||||

| 4 | Marathon Petroleum Corporation | |||||||

| PROXY STATEMENT SUMMARY | ||

| Governance Highlights | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Key Corporate Governance Practices | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Board of Directors believes that our commitment to strong corporate governance benefits all our stakeholders, including our shareholders, employees, business partners, customers, communities, governments and others who have a stake in how we operate. Our key corporate governance practices include: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BOARD INDEPENDENCE AND LEADERSHIP | SHAREHOLDER RIGHTS AND ENGAGEMENT | ESG | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Strong independent Chairman role reinforces effective independent leadership on the Board Three fully independent standing Board committees | Majority voting standard for uncontested director elections Demonstrated commitment to Board diversity Directors not elected by a majority of votes cast are subject to the Board’s resignation policy | Risk oversight by the full Board and its committees Independent directors meet regularly in executive session Annual Board and committee self-evaluations, and individual evaluations of nominees for reelection | Shareholder right to call a special meeting of shareholders Robust year-round shareholder engagement program | Strong oversight by the full Board and its Industry-leading disclosures on environmental targets and performance Extensive human capital management disclosures, including EEO-1 data | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Recent Governance Enhancements | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| We believe good governance is critical to achieving long-term shareholder value. We approach governance in a strategic and thoughtful manner, taking into consideration multiple perspectives, including those of our Board, our Corporate Governance and Nominating Committee, our shareholders, experts and other stakeholders, to align on what makes the most sense for our Company. We continuously look for ways to enhance our corporate governance and increase value to our shareholders. Recent governance enhancements and actions include: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2021- 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ▶ | Submitting to our shareholders, for consideration at the 2024 Annual Meeting, an amendment to our Certificate of Incorporation providing for officer exculpation, as permitted under Delaware law | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ▶ | Following approval from our shareholders, amended our Certificate of Incorporation to increase | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ▶ | Revised our Corporate Governance Principles to affirmatively state the Board’s policy on director commitments | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ▶ | Following a thorough review of Board committee oversight responsibilities, amended our committee charters to adjust and clarify committee responsibilities, including for ESG oversight and stakeholder engagement | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ▶ | Elected an independent Chairman of the Board | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ▶ | Submitted to our shareholders, for consideration at the 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2019 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ▶ | Amended our Corporate Governance Principles to require individual director evaluations for directors whose terms expire at the next annual meeting and are eligible for reelection | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ▶ | Amended our Bylaws to | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ▶ | Amended our Corporate Governance Principles to expressly affirm the Board’s commitment to actively seek diverse candidates for Board service | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ▶ | Amended our Bylaws to eliminate the 80% supermajority requirement for Bylaw amendments approval threshold for Bylaw amendments is now a majority of outstanding shares | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ▶ | Amended our Bylaws to provide proxy access for shareholders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | ||||||||

| PROXY STATEMENT SUMMARY | ||

| Sustainability Highlights | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STRENGTHEN RESILIENCY | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Strengthening our business for today, while building durability for the future | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

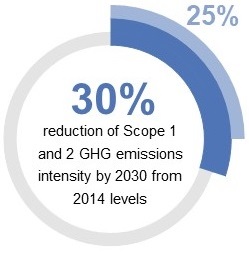

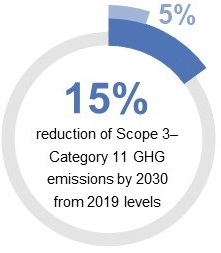

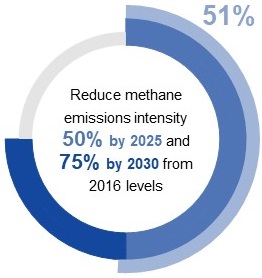

| Robust Suite of Climate-Related Targets and Accomplishments | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Energy Star® Partner of the Year – Sustained Excellence, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

•Reported on our 2030 target to reduce absolute Scope 3 emissions •Progressed toward our 2030 methane emissions intensity reduction target •Advanced progress on our pipeline right-of-way biodiversity target |  | Our refineries have earned more ENERGY STAR certifications for energy efficiency than all other refineries in the U.S. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diversified Portfolio |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Largest natural gas processor in the U.S., facilitating approximately 250million tonnes of CO2e reductions per year from | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

* See our most recent Climate Report on our website for additional information on how we calculate GHG intensity and CO2e reductions | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| INNOVATE FOR THE FUTURE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investing in the energy evolution to lower carbon intensity and capture value | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Renewable Fuels | Martinez, CA – Renewable Fuels Facility 50/50 Joint Venture | Dickinson, ND – Renewable Diesel Facility | Capital Allocation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Began producing renewable diesel | Produced nearly | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| in the |  | 149 million |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EMBED SUSTAINABILITY | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Embracing sustainability in decision-making, how we engage our people and how we create value with stakeholders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Engaging Our Stakeholders and Communities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| •Strong safety management systems and | •Comprehensive approach to stakeholder engagement across the Company •Robust engagement with tribal stakeholders in our operational footprint |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

American Fuel & Petrochemical Manufacturers (AFPM) Safety Awards Three MPC refineries recognized for top safety performance and innovation | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

•Published Just Transition Report focused on the potential social impacts of the energy transition, and published a case study, “Working Toward a Just and Responsible Transition,” in our Sustainability Report •Regular dialogue with investor stewardship teams; reporting and disclosures aligned with TCFD, SASB, CDP and GRI | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investing in Our Employees | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

•Offering competitive pay and benefits and extensive professional development opportunities •MPC employee average tenure of 10 years •4,000+ employees belong to our employee networkgroups | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Leading in Sustainability | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | Marathon Petroleum Corporation | |||||||

| PROXY STATEMENT SUMMARY | ||

| Executive Compensation Highlights | ||||||||||||||||||||||||||||||||||||||||||||

| Executive Compensation Guiding Principles | ||||||||||||||||||||||||||||||||||||||||||||

| We believe our executive compensation program plays a critical role in maximizing long-term value for our shareholders, employees and other stakeholders. Our executive compensation guiding principles are embodied in our executive compensation program and policies, which are designed to: | ||||||||||||||||||||||||||||||||||||||||||||

| v | Attract, retain, motivate and reward the highest-quality executive team by providing market-competitive compensation. | |||||||||||||||||||||||||||||||||||||||||||

| v | Be simple and transparent so they can be clearly communicated both internally and externally. | |||||||||||||||||||||||||||||||||||||||||||

| v | Create direct alignment between executive pay and the creation of shareholder value. | |||||||||||||||||||||||||||||||||||||||||||

| v | Reward for execution of our business strategy and desired culture. | |||||||||||||||||||||||||||||||||||||||||||

| v | Differentiate pay on the basis of performance, experience and skill set. | |||||||||||||||||||||||||||||||||||||||||||

| 2022 Target Compensation Mix | ||||||||||||||||||||||||||||||||||||||||||||

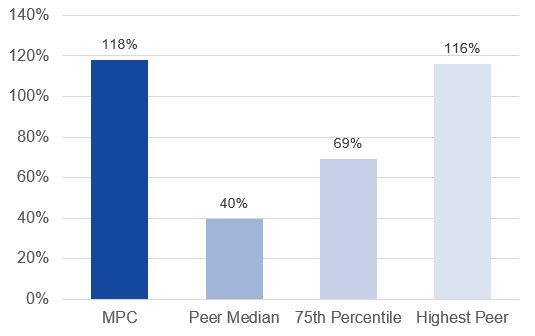

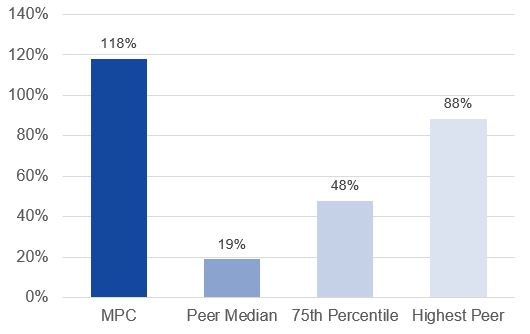

| The Compensation and Organization Development Committee believes using a mix of cash and equity compensation encourages and motivates our named executive officers (“NEOs”) to achieve both our short-term and long-term business objectives. Consistent with our guiding principles that executive compensation should reward for performance and be directly aligned with creating value for our shareholders, a substantial majority of our NEOs’ compensation is at-risk and based on performance metrics tied to our business strategy and culture. | ||||||||||||||||||||||||||||||||||||||||||||

| Base Salary | Annual Cash Bonus | MPC Performance Share Units | MPC Restricted Stock Units | MPLX Phantom Units | ||||||||||||||||||||||||||||||||||||||||

| CEO | 10% | 16% | 44% | 15% | 15% | |||||||||||||||||||||||||||||||||||||||

| 60% Performance-Based | 30% Time-Based | |||||||||||||||||||||||||||||||||||||||||||

| 90% At Risk | ||||||||||||||||||||||||||||||||||||||||||||

Other Current NEOs Average | Base Salary | Annual Cash Bonus | MPC Performance Share Units | MPC Restricted Stock Units | MPLX Phantom Units | |||||||||||||||||||||||||||||||||||||||

| 21% | 17% | 37% | 12.5% | 12.5% | ||||||||||||||||||||||||||||||||||||||||

| 54% Performance-Based | 25% Time-Based | |||||||||||||||||||||||||||||||||||||||||||

| 79% At Risk | ||||||||||||||||||||||||||||||||||||||||||||

“Performance-Based” means there is no guarantee that any value at all will be realized if the performance criteria are not met. | ||||||||||||||||||||||||||||||||||||||||||||

“At-Risk” means there is no guarantee that the target value will be realized. | ||||||||||||||||||||||||||||||||||||||||||||

| Leading Practices in Executive Compensation | ||||||||||||||||||||||||||||||||||||||||||||

| Our executive compensation program demonstrates our commitment to sound compensation and governance practices, promotes the objectives set forth in our guiding principles and serves our shareholders’ long-term interests. | ||||||||||||||||||||||||||||||||||||||||||||

| ü | Majority of total target compensation is performance-based | ü | Compensation and Organization Development Committee oversight of annual compensation risk assessment | |||||||||||||||||||||||||||||||||||||||||

| ü | Performance measures align with shareholder interests | |||||||||||||||||||||||||||||||||||||||||||

| ü | Significant stock ownership requirements | û | No guaranteed minimum bonus | |||||||||||||||||||||||||||||||||||||||||

| ü | Performance metric achievement capped at 200% | û | No excise tax gross-ups | |||||||||||||||||||||||||||||||||||||||||

| ü | Recoupment/clawback provisions for both long-term incentive (“LTI”) and short-term incentive awards | û | No tax gross-ups on perquisites (other than for relocation reimbursements in limited circumstances) | |||||||||||||||||||||||||||||||||||||||||

| ü | “Double trigger” LTI vesting in a change of control | û | Policy prohibiting hedging or pledging | |||||||||||||||||||||||||||||||||||||||||

| ü | ESG metrics tied to executive and employee compensation | û | No dividend equivalents paid on unvested awards | |||||||||||||||||||||||||||||||||||||||||

| ü | Limited perquisites and personal benefits | û | No repricing of stock options (no longer granted) | |||||||||||||||||||||||||||||||||||||||||

| Executive Compensation Highlights | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Leading Executive Compensation Practices | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Our executive compensation program demonstrates our commitment to sound compensation and governance practices, promotes the objectives in our guiding principles and serves our shareholders’ long-term interests. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ü | Majority of total target compensation is performance-based | ü | Annual compensation risk assessment overseen by Compensation and Organization Development Committee | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ü | Performance measures align with shareholder interests | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ü | Significant stock ownership requirements | û | No guaranteed minimum bonuses | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ü | Performance metrics achievement capped at 200% | û | No excise tax gross-ups | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ü | Clawback provisions for both long-term and short-term incentive awards | û | No tax gross-ups on perquisites (other than for relocation reimbursements in limited circumstances) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ü | “Double trigger” LTI vesting in a change of control | û | No dividend equivalents paid on unvested awards | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ü | Executive and employee compensation tied to financial and non-financial performance | û | Policy prohibiting executives from hedging or pledging our securities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ü | Limited perquisites and personal benefits | û | Discontinued grants of stock options | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 Target Compensation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Compensation and Organization Development Committee believes using a mix of cash and equity compensation encourages and motivates our NEOs to achieve both our short-term and long-term business objectives. Consistent with our guiding principles that executive compensation should reward performance and be directly aligned with creating value for our shareholders, a substantial majority of our NEOs’ compensation is at-risk and based on performance metrics tied to our business strategy and culture. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Base Salary | Annual Cash Bonus | MPC Performance Share Units | MPC Restricted Stock Units | MPLX Phantom Units | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CEO | 10% | 16% | 44% | 15% | 15% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 60% Performance-Based | 30% Time-Based | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 90% At-Risk | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

OTHER NEOs Average | Base Salary | Annual Cash Bonus | MPC Performance Share Units | MPC Restricted Stock Units | MPLX Phantom Units | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 21% | 18% | 37% | 12% | 12% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 55% Performance-Based | 24% Time-Based | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 79% At-Risk | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Following is the target compensation for our NEOs under our 2023 executive compensation program. For additional information, see “Executive Compensation” beginning on page 35. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Named Executive Officers | Annual Base Salary ($) | Target ACB (%) | Target ACB ($) | Target Long-Term Incentives ($) | Total Target Compensation ($) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Michael J. Hennigan President and CEO* | $1,750,000 | 165% | $2,887,500 | $13,400,000 | $18,037,500 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Maryann T. Mannen Executive Vice President and CFO* | $1,000,000 | 110% | $1,100,000 | $4,000,000 | $6,100,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Timothy J. Aydt Executive Vice President Refining | $845,000 | 100% | $845,000 | $2,400,000 | $4,090,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Suzanne Gagle General Counsel and Senior Vice President Government Affairs* | $750,000 | 80% | $600,000 | $2,400,000 | $3,750,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Gregory S. Floerke Executive Vice President and Chief Operating Officer of MPLX LP LLC | $620,000 | 70% | $434,000 | $1,300,000 | $2,354,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| * Effective January 1, 2024, Ms. Mannen was elected President of MPC, and Mr. Hennigan ceased serving in that role. Mr. Hennigan continues to serve as our CEO. Effective January 5, 2024, Ms. Gagle retired following more than 30 years of service to MPC. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 | ||||||||

| CORPORATE GOVERNANCE | ||

| Proposal 1. Election of Directors | ||

| ü | The Board of Directors recommends you vote FOR each of the following Class | ||||||||||||||||

| The Board of Directors, which oversees the management of our business and affairs, currently is divided into three classes of directors, with one class being elected each year for a three-year term. The Board has set the current number of directors at | ||

As informed by our individual director evaluation process discussed further on page | ||

| DIRECTOR SKILLS, EXPERTISE AND DEMOGRAPHIC MATRIX* |  | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|  |  |  |  |  |  |  |  |  |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DIRECTOR SKILLS, EXPERTISE AND COMPOSITION* | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DIRECTOR SKILLS, EXPERTISE AND COMPOSITION* | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DIRECTOR SKILLS, EXPERTISE AND COMPOSITION* | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MPC Board Tenure (years) | MPC Board Tenure (years) | 6 | 3 | 5 | 12 | 8 | 5 | 6 | 12 | 5 | — | 5.5 Years Average Tenure | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

MPC Board Tenure (years) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

MPC Board Tenure (years) | 7 | 4 | 3 | 13 | 9 | 0 | 6 | 0 | 7 | 13 | 6 | 5.9 Years Average Tenure | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Director Independence | Director Independence | ü | ü | ü | ü | ü | ü | ü | 92% Independent | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Key Skills and Expertise | Key Skills and Expertise | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Senior Leadership | Senior Leadership | ü | ü | ü | ü | 12/12 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Senior Leadership | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Senior Leadership | ü | ü | ü | ü | ü | ü | 13/13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Public Company CEO | Public Company CEO | ü | ü | ü | ü | ü | 7/13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Risk Management | Risk Management | ü | ü | ü | 12/12 | Risk Management | ü | ü | ü | ü | ü | ü | 13/13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Governance | Corporate Governance | ü | ü | ü | 12/12 | Corporate Governance | ü | ü | ü | ü | ü | ü | 13/13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Finance & Accounting | Finance & Accounting | ü | ü | ü | ü | ü | 11/12 | Finance & Accounting | ü | ü | ü | ü | ü | ü | ü | 12/13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Energy Industry | Energy Industry | ü | ü | ü | 9/12 | Energy Industry | ü | ü | ü | ü | ü | ü | 9/13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Business | International Business | ü | ü | ü | ü | ü | ü | 9/13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sustainability | Sustainability | ü | ü | ü | ü | ü | 12/12 | Sustainability | ü | ü | ü | ü | ü | ü | 13/13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Environment | Environment | ü | ü | ü | ü | 5/13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Government, Legal & Regulatory | Government, Legal & Regulatory | ü | ü | ü | ü | ü | 7/12 | Government, Legal & Regulatory | ü | ü | ü | ü | ü | ü | 6/13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Age (at April 26, 2023) | 69 | 52 | 63 | 71 | 67 | 73 | 72 | 56 | 64 | 68 | 70 | 59 | 65.9 Years Average Age | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Technology & Cybersecurity | Technology & Cybersecurity | ü | ü | ü | ü | 5/13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Age (at April 24, 2024) | Age (at April 24, 2024) | 70 | 53 | 64 | 72 | 68 | 74 | 54 | 73 | 57 | 58 | 65 | 69 | 71 | 65.2 Years Average Age | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gender | Gender | Male | ¡ | ¡ | ¡ | 75% | Gender | Male | ¡ | ¡ | ¡ | ¡ | ¡ | ¡ | ¡ | 69% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Female | ¡ | ¡ | 25% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Female | Female | ¡ | ¡ | ¡ | ¡ | 31% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Race, Ethnicity and Native American Tribal Membership | Race, Ethnicity and Native American Tribal Membership | ¡ | ¡ | ¡ | ¡ | 33% | Race, Ethnicity and Native American Tribal Membership | ¡ | ¡ | ¡ | ¡ | 31% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Diversity | Total Diversity | ¡ | ¡ | ¡ | ¡ | 42% | Total Diversity | ¡ | ¡ | ¡ | ¡ | ¡ | ¡ | 46% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CLASS I | CLASS II | CLASS III | * Reflects expected composition of the Board following the Annual Meeting, assuming all Class III director nominees are elected. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CLASS I | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| * Reflects expected composition of the Board following the Annual Meeting, assuming all Class I director nominees are elected. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| * Reflects expected composition of the Board following the Annual Meeting, assuming all Class I director nominees are elected. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| * Reflects expected composition of the Board following the Annual Meeting, assuming all Class I director nominees are elected. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | Marathon Petroleum Corporation | |||||||

| PROPOSAL 1. ELECTION OF DIRECTORS | ||

| CLASS | |||||||||||||||||||||||||||||

| Term expires | |||||||||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||||||||

| ü | Senior leadership | ü | Finance | ü | Sustainability | ||||||||||||||||||||||||

| ü | Risk management | ü | Energy industry | ||||||||||||||||||||||||||

| ü | Corporate governance | ü | International business | ||||||||||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||||||||

| v | Senior Vice President of Industrial Relations (2007-2014), Senior Vice President of Refining, Marketing and International (2001-2007), Senior Vice President, International Operations (2000-2001) of Saudi Arabian Oil Company (Saudi Aramco) | ||||||||||||||||||||||||||||

Independent Director Age: 70 Director since: 2016 MPC Board Committees: Audit Compensation and Organization Development Sustainability and Public Policy, Vice Chair | |||||||||||||||||||||||||||||

| v | Thirty-three year career at Saudi Aramco, beginning in various field positions and progressing through management roles of increasing responsibility | ||||||||||||||||||||||||||||

Other Public Company Directorships (current): Halliburton Company (since 2014); National Gas & Industrialization Company (since 2019) | |||||||||||||||||||||||||||||

Other Public Company Directorships (within past five years): None | |||||||||||||||||||||||||||||

Education: B.S., Mechanical Engineering, University of California, Irvine; M.B.A., University of California, Irvine; Advanced Management Program, University of Pennsylvania | |||||||||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||||||||

| Director, Saudi Electricity Company (2018-2020) | |||||||||||||||||||||||||||||

| Member, Board of Directors for the International Youth Foundation | |||||||||||||||||||||||||||||

| Jonathan Z. Cohen | CLASS I DIRECTOR NOMINEE | ||||||||||||||||||||||

| Founder, CEO and President, Hepco Capital Management, LLC | Term expires 2024 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Corporate governance | ü | Sustainability | ||||||||||||||||||

| ü | Public company CEO | ü | Finance & accounting | ü | Government, legal & regulatory | ||||||||||||||||||

| ü | Risk management | ü | Energy industry | ü | Technology & cybersecurity | ||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | |||||||||||||||||||||||

Independent Director Age: 53 Director since: 2019 MPC Board Committees: Audit, Vice Chair Corporate Governance and Nominating | v | Co-Chairman (2019-2021) and CEO | |||||||||||||||||||||

| v | Chairman of the | ||||||||||||||||||||||

| v | President and CEO (2004-2016), Resource America, Inc., an asset management company | ||||||||||||||||||||||

| v | Co-founder and various executive roles at Atlas Pipeline Partners, LP and Atlas Energy, Inc. | ||||||||||||||||||||||

Other Public Company Directorships (current): None | |||||||||||||||||||||||

Other Public Company Directorships (within past five years): Atlas Energy Group, LLC (2012-2019); Energen Corporation (2018-2019); Falcon Minerals Corporation (2017-2020); Osprey Technology Acquisition Corp. (2019-2021); Titan Energy, LLC (2016-2019) | |||||||||||||||||||||||

Education: B.A., University of | |||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| Co-founder, Castine Capital Management, LLC (2003-2020) | |||||||||||||||||||||||

| Vice Chairman, Lincoln Center Theater; Trustee, East Harlem School; Trustee, Arete Foundation; Trustee, American School of Classical Studies in Athens, Greece | |||||||||||||||||||||||

| Member, Board of Overseers, College of Arts and Sciences, University of Pennsylvania | |||||||||||||||||||||||

| 2024 Proxy Statement | 9 | |||||||

| PROPOSAL 1. ELECTION OF DIRECTORS | ||

| Michael J. Hennigan | CLASS I DIRECTOR NOMINEE | ||||||||||||||||||||||

| CEO, Marathon Petroleum Corporation | Term expires 2024 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Finance & accounting | ü | Sustainability | ||||||||||||||||||

| ü | Public company CEO | ü | Energy industry | ü | Environment | ||||||||||||||||||

| ü | Risk management | ü | International business | ü | Technology & cybersecurity | ||||||||||||||||||

| ü | Corporate governance | ||||||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | CEO (since January 2024), President and CEO (2020-2023) and director (since 2020) of MPC; Chairman (since 2020), CEO (since 2019) and President and director (since 2017) of MPLX | ||||||||||||||||||||||

Management Director Age: 64 Director since: 2020 MPC Board Committees: Sustainability and Public Policy | |||||||||||||||||||||||

| v | President, Crude, NGL and Refined Products (2017), of the general partner of Energy Transfer Partners L.P., a | ||||||||||||||||||||||

| v | President and CEO (2012-2017), President and Chief Operating Officer (2010-2012) and Vice President, Business Development (2009-2010), of Sunoco Logistics Partners L.P., an energy service provider | ||||||||||||||||||||||

Other Public Company Directorships (current): MPLX GP LLC* (since 2017); Nutrien Ltd. (since 2022) | |||||||||||||||||||||||

Other Public Company Directorships (within past five years):Tesoro Logistics GP, LLC (2018-2019) | |||||||||||||||||||||||

Education: B.S., Chemical Engineering, Drexel University | |||||||||||||||||||||||

| Frank M. Semple | CLASS I DIRECTOR NOMINEE | ||||||||||||||||||||||

| Retired Chairman, President and CEO, MarkWest Energy Partners, L.P. | Term expires 2024 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Corporate governance | ü | Sustainability | ||||||||||||||||||

| ü | Public company CEO | ü | Finance & accounting | ||||||||||||||||||||

| ü | Risk management | ü | Energy industry | ||||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | Vice Chairman (2015-2016) and director (since 2015) of MPLX following MPLX’s acquisition of MarkWest Energy Partners, L.P. | ||||||||||||||||||||||

Independent Director Age: Director since: (previous MPC Board member 2015-2018) MPC Board Committees: Audit | |||||||||||||||||||||||

| v | |||||||||||||||||||||||

| v | Twenty-two years of service | ||||||||||||||||||||||

Other Public Company Directorships (current): MPLX GP LLC* (since | |||||||||||||||||||||||

Other Public Company Directorships (within past five years): | |||||||||||||||||||||||

Education: B.S., | |||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| Service in the United States Navy | |||||||||||||||||||||||

| Member, Board of | |||||||||||||||||||||||

| |||||||||||||||||

| * | Under our Corporate Governance Principles, due to their affiliate nature, concurrent service on the boards of MPC and MPLX GP LLC is counted as one public company board for purposes of assessing the level of public company board commitments. | ||||

| PROPOSAL 1. ELECTION OF DIRECTORS | ||

| CLASS | |||||||||||||||||||||||

| Term expires | |||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ||||||||||||||||||||

| ü | Senior leadership | ü | Finance | ü | Government, legal & regulatory | |||||||||||||||

| ü | Risk management | ü | ||||||||||||||||||

| ü | ||||||||||||||||||||

| ||||||||||||||||||||

| ü | Corporate governance | ü | Sustainability | |||||||||||||||||

| Career Highlights: | ||||||||||||||||||||

| v | Senior | |||||||||||||||||||

| v | U.S. Senator (1999-2011); served on Senate committees including Banking, Housing and Urban Affairs; Armed Services; Energy and Natural Resources; Select Committee on Intelligence; Small Business and Entrepreneurship; Special Committee on Aging; chaired the International Trade and Finance Subcommittee | |||||||||||||||||||

Independent Director Age: Director since: MPC Board Committees: Sustainability and Public Policy, | ||||||||||||||||||||

| v | ||||||||||||||||||||

| v | Senior Advisor and Of Counsel, Cozen O’Connor Public Strategies, a law firm (2018-2019) | |||||||||||||||||||

| v | Partner, McGuireWoods LLP, a global diversified law firm (2011-2018) | |||||||||||||||||||

Other Public Company Directorships (current): | ||||||||||||||||||||

Other Public Company Directorships (within past five years): None | ||||||||||||||||||||

Education: B.S., | ||||||||||||||||||||

Other Professional Experience and Community Involvement: | ||||||||||||||||||||

| CLASS | |||||||||||||||||||||||

| Term expires | |||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ||||||||||||||||||||||

| |||||||||||||||||||||||

| ü | Corporate governance | ü | Sustainability | ||||||||||||||||||||

| ü | Public company CEO | ü | Finance & accounting | ||||||||||||||||||||

| ü | Risk management | ü | International business | ||||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | Chairman and CEO (2005-2015) and Executive Chairman (2015-2016) of PPG Industries, Inc. a global supplier of paints and coatings | ||||||||||||||||||||||

Independent Director Age: 74 Director since: 2015 MPC Board Committees: Compensation and Organization Development Corporate Governance and Nominating, Chair | v | President, Chief Operating Officer and | |||||||||||||||||||||

| v | Thirty-six year career at PPG Industries, serving in various roles in finance and planning, marketing and general management in the United States and Europe, including as Senior Vice President | ||||||||||||||||||||||

Other Public Company Directorships (current): | |||||||||||||||||||||||

Other Public Company Directorships (within past five years):ConocoPhillips (2014-2022); The PNC Financial Services Group, Inc. (2007-2022) | |||||||||||||||||||||||

Education: B.S., | |||||||||||||||||||||||

| Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| Former Chairman, National Association of Manufacturers | |||||||||||||||||||||||

| Former Chairman, board of the Federal Reserve Bank of Cleveland | |||||||||||||||||||||||

| 2024 Proxy Statement | 11 | |||||||

| PROPOSAL 1. ELECTION OF DIRECTORS | ||

| CLASS | |||||||||||||||||||||||

| Term expires | |||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Finance | ü | Technology & cybersecurity | ||||||||||||||||||

| ü | Risk management | ü | International business | ||||||||||||||||||||

| ü | Corporate governance | ü | Sustainability | ||||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | Founder and CEO of KET Solutions, LLC, a consulting firm (since 2021) | ||||||||||||||||||||||

| v | Executive Director, Finance Thought Leadership (2019), Global Strategy Leader, Cloud Business Group (2018-2019), Global Strategy Director, Financial Services Industry Group (2015-2018), and Executive Director and Global Leader for Health, Human Services and Labor Solutions Group (2004-2015) of Oracle Corporation | ||||||||||||||||||||||

Independent Director Age: 54 Director since: 2024 MPC Board Committees: Audit Corporate Governance and Nominating | |||||||||||||||||||||||

| v | Chief Information & Technology Officer, Prince George’s County, Maryland (2001-2004) | ||||||||||||||||||||||

Other Public Company Directorships (current): EverCommerce Inc. (since 2021); U.S. Bancorp (since 2021) | |||||||||||||||||||||||

Other Public Company Directorships (within past five years): None | |||||||||||||||||||||||

Education: B.A., Information Systems Management, University of Maryland; M.B.A., Business Administration and Decision Science, Loyola University Maryland; M.S., Information Technology Management, Carnegie Mellon University | |||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| Member, Board of Directors, Mutual of Omaha Insurance Corporation (since 2020) | |||||||||||||||||||||||

| Adjunct Professor, Heinz College of Information Systems and Public Policy, Carnegie Mellon University | |||||||||||||||||||||||

| Former Chairman, American Institute of CPAs; Former Chairman, Association of International Certified Professional Accountants | |||||||||||||||||||||||

| Certified public accountant; certified internal auditor; certified information systems auditor | |||||||||||||||||||||||

| Edward G. Galante | CLASS II DIRECTOR | |||||||||||||||||||||||||

| Retired Senior Vice President and Management Committee Member, ExxonMobil Corporation | Term expires 2025 | |||||||||||||||||||||||||

| Key Skills and Expertise | |||||||||||||||||||||||||

| ü | Senior leadership | ü | Energy industry | ü | Environment | |||||||||||||||||||||

| ü | Risk management | ü | International business | |||||||||||||||||||||||

| ü | Corporate governance | ü | Sustainability | |||||||||||||||||||||||

| Career Highlights: | ||||||||||||||||||||||||||

| v | Senior Vice President and Management Committee member of ExxonMobil Corporation (2001-2006) | |||||||||||||||||||||||||

Independent Director Age: 73 Director since: 2018 MPC Board Committees: Compensation and Organization Development, Chair Sustainability and Public Policy | v | More than 30 years of service at ExxonMobil Corporation in roles of increasing responsibility, including Executive Vice President of ExxonMobil Chemical Company (1999-2001) | ||||||||||||||||||||||||

Other Public Company Directorships (current): Celanese Corporation (since 2013), Lead Director (2016-2021); Clean Harbors, Inc. (since 2010), Lead Director (since 2023) | ||||||||||||||||||||||||||

Other Public Company Directorships (within past five years): Andeavor (2016-2018); Linde PLC (2018-2023); Praxair, Inc. (2007-2018) | ||||||||||||||||||||||||||

Education: B.S., Civil Engineering, Northeastern University; Advanced Executive Program, Northwestern University | ||||||||||||||||||||||||||

Other Professional Experience and Community Involvement: | ||||||||||||||||||||||||||

| Member, Board of Directors, United Way Foundation of Metropolitan Dallas | ||||||||||||||||||||||||||

| Vice Chairman, Board of Trustees, Northeastern University | ||||||||||||||||||||||||||

| Member, Board of Directors, Artis-Naples | ||||||||||||||||||||||||||

| 12 | Marathon Petroleum Corporation | |||||||

| PROPOSAL 1. ELECTION OF DIRECTORS | ||

| Kim K.W. Rucker | CLASS II DIRECTOR | ||||||||||||||||||||||

| Former Executive Vice President, General Counsel and Secretary, Andeavor | Term expires 2025 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Finance & accounting | ü | Sustainability | ||||||||||||||||||

| ü | Risk management | ü | Energy industry | ü | Government, legal & regulatory | ||||||||||||||||||

| ü | Corporate governance | ü | International business | ü | Technology & cybersecurity | ||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | Executive Vice President, General Counsel and Secretary of Andeavor (2016-2018); Executive Vice President and General Counsel of Tesoro Logistics GP, LLC (2016-2018) | ||||||||||||||||||||||

Independent Director Age: 57 Director since: 2018 MPC Board Committees: Audit Compensation and Organization Development, Vice Chair Sustainability and Public Policy | v | Executive Vice President, Corporate & Legal Affairs, General Counsel and Corporate Secretary of Kraft Foods Group, Inc., a grocery manufacturing and processing company (2012-2015) | |||||||||||||||||||||

| v | Senior Vice President, General Counsel and Chief Compliance Officer (2008-2012) and Corporate Secretary (2009-2012) of Avon Products, Inc. | ||||||||||||||||||||||

| v | Senior Vice President, Corporate Secretary and Chief Governance Officer of Energy Future Holdings Corp. (formerly TXU Corp.) (2004-2008) | ||||||||||||||||||||||

| v | Former Partner in the Corporate & Securities group at Sidley Austin LLP, a law firm | ||||||||||||||||||||||

Other Public Company Directorships (current): Celanese Corporation (since 2018); HP Inc. (since 2021); GE Vernova* (since 2024) | |||||||||||||||||||||||

Other Public Company Directorships (within past five years): Lennox International Inc. (2015-2024) | |||||||||||||||||||||||

Education: B.B.A., Economics, University of Iowa; J.D., Harvard Law School; M.P.P., John F. Kennedy School of Government at Harvard University | |||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| * Spinoff as public company planned for second quarter 2024 | Member, Board of Trustees, Johns Hopkins Medicine | ||||||||||||||||||||||

| Member, Board of Directors, Haven for Hope | |||||||||||||||||||||||

| 2024 Proxy Statement | 13 | |||||||

| PROPOSAL 1. ELECTION OF DIRECTORS | ||

| Eileen P. Drake | CLASS III DIRECTOR | ||||||||||||||||||||||||||||

| Former CEO and President, Aerojet Rocketdyne Holdings, Inc. | Term expires 2026 | ||||||||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||||||||

| ü | Senior leadership | ü | Corporate governance | ü | Sustainability | ||||||||||||||||||||||||

| ü | Public company CEO | ü | Finance & accounting | ü | Government, legal & regulatory | ||||||||||||||||||||||||

| ü | Risk management | ü | International business | ||||||||||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||||||||

| v | CEO and President (2015-2023) and Chief Operating Officer (2015) of Aerojet Rocketdyne Holdings, Inc. | ||||||||||||||||||||||||||||

| v | Various roles in senior management at United Technologies Corporation (2003-2015), including as Division President, Pratt & Whitney AeroPower (2013-2015); Vice | ||||||||||||||||||||||||||||

Independent Director Age: Director since: MPC Board Committees: Compensation and Organization Development Sustainability and Public Policy | |||||||||||||||||||||||||||||

| v | |||||||||||||||||||||||||||||

Other Public Company Directorships (current): | |||||||||||||||||||||||||||||

Other Public Company Directorships (within past five years): | |||||||||||||||||||||||||||||

Education: | |||||||||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||||||||

| Former member, Board of Governors, Aerospace Industries Association | |||||||||||||||||||||||||||||

| Former member, National Space Council Users’ Advisory Group | |||||||||||||||||||||||||||||

| J. Michael Stice | CLASS III DIRECTOR | ||||||||||||||||||||||

| Professor, The University of Oklahoma | Term expires 2026 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Corporate governance | ü | International business | ||||||||||||||||||

| ü | Public company CEO | ü | Finance & accounting | ü | Sustainability | ||||||||||||||||||

| ü | Risk management | ü | Energy industry | ü | Environment | ||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | Dean, Mewbourne College of Earth & Energy at The University of Oklahoma (2015-2022) | ||||||||||||||||||||||

| v | CEO (2009-2014) and member of the board of directors (2012-2015) of Access Midstream Partners L.P., a publicly traded gathering and processing master limited partnership | ||||||||||||||||||||||

Independent Director Age: 65 Director since: 2017 MPC Board Committees: Audit Corporate Governance and Nominating, Vice Chair Sustainability and Public Policy | |||||||||||||||||||||||

| v | Nearly 30 years of service in positions of increasing responsibility at ConocoPhillips and its predecessor companies, including as President of ConocoPhillips Qatar (2003-2008) | ||||||||||||||||||||||

Other Public Company Directorships (current): Kosmos Energy Ltd. (since 2023); MPLX GP LLC* (since 2018) | |||||||||||||||||||||||

Other Public Company Directorships (within past five years): Spartan Acquisition Corp. II (2020-2021); Spartan Acquisition Corp. III (2021-2022); Spartan Energy Acquisition Corp. (2018-2020); U.S. Silica Holdings, Inc. (2013-2021) | |||||||||||||||||||||||

Education: B.S., Chemical Engineering, The University of Oklahoma; M.S., Business, Stanford University; Ed.D, Organizational Leadership, The George Washington University | |||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| Member, Board of Advisors, Energy Institute, The University of Oklahoma | |||||||||||||||||||||||

| Co-leader, Oklahoma Solve Climate by 2030, Center for Environmental Policy at Bard College | |||||||||||||||||||||||

| * | Under our Corporate Governance Principles, due to their affiliate nature, concurrent service on the boards of MPC and MPLX GP LLC is counted as one public company board for purposes of assessing the level of public company board commitments. | ||||

| Marathon Petroleum Corporation | ||||||||

| PROPOSAL 1. ELECTION OF DIRECTORS | ||

| CLASS | |||||||||||||||||||||||

| Term expires | |||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ||||||||||||||||||||||

| ü | Corporate governance | ü | |||||||||||||||||||||